First of all, that title is some top-notch gratuitous clickbait. Of course I can’t guarantee anything with regard to the stock market (except maybe over a 10+ year timeframe). Rather, I’m going to make a concentrated and strong case for why U.S. stocks markets will go up this year and the next couple years.

The Case For a Fall

About a week ago my dad called me. My uncle had spoken to him with a recommendation to temper his stock exposure based on an expectation that the markets are due for a fall. The prognosis for markets to decline this year is quite reasonable. The current bull market (with “bull market” defined as a gains of >20% over a time period >6 months) that began on March 9th, 2009 is now almost six-years old. Since 1932, the average bull market has run for just about 5 years; this bull market has been unusually long. What’s more, this bull market has been unusually consistent. Within this six year bull, we’ve had only three corrections of 10% or more and only two of 15% or more. Looking at the chart below, historically we’d expect to have about twice the number of corrections that we’ve actually had.

Finally, this bull market has been unusually strong. The average bull market since 1932 has gained about 185%; our current bull market is at a gain of 208% as of this writing.

Based on historical length, strength, and consistency precedents, it’s logical to think that markets have become overheated.

Granted, just because stock prices have gone up so consistently for so long doesn’t inherently mean they should go down. I mean, Apple is worth a heckuva lot more now than it was ten years ago, but the rise is well deserved because the underlying fundamentals are so much stronger. The same goes for the overall market; if the intrinsic value of the market has gone up, then price increases can be justified. But, even that argument is getting stretched. On a TTM (trailing-twelve-month) price-to-earnings basis, markets are also getting a bit expensive…

This chart gives the historical earnings multiple (P/E ratio) of the S&P 500. The median P/E ratio over the last ~100 years has been about 15; we’re just shy of 20 right now. On a ttm P/E basis, markets would have to fall 25% just to get in line with historical prices.

But wait, you say. The U.S. economy is in a period of tremendous growth. Real GDP growth last quarter (Q3 ’14), was 5%. So, we’re growing fast, inflation is very low (<2%), we’re in a secular energy renaissance and increasing our net energy exports (http://www.eia.gov/dnav/pet/pet_move_wkly_dc_nus-z00_mbblpd_w.htm) every year, lower food and energy prices are stimulating the consumer economy, the dollar is strengthening, foreign investment is flowing in—we’re the United States for cryin’ out loud! Those things are all true, for certain. So, maybe the ~20 P/E is appropriate given the earnings growth we’re going to see over the next year and more. Okay, so let’s look at the P/E with that in mind—market prices based on projected forward earnings.

Source: Business Insider

Okay, so I’m sensing a theme here. That graphic is a few months old, so we’re actually a bit pricier than that 15.7x (we’re at 16.2 as of today). This high P/E isn’t unprecedented. We were much higher than 16.2x during the dot-com bubble (that ended badly) and again in 2003/2004 (that went well, at least until 2008). But, by all accounts, you can at least say we’re above average based on forward P/E. Should earnings disappoint, we could be in for some hurt.

So, this is a brief case for why markets seem due for a fall. Other things could happen to drive down markets, but that’s a valuation case. Now, I’m going to tell you the one thing that will keep markets rising…

Interest Rates are the Market’s White Knight

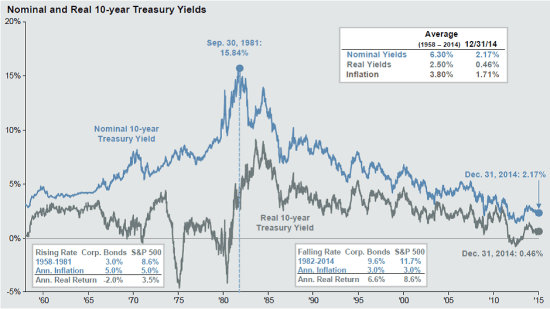

We really are living in a period of time that most people in the U.S. have never experienced. As most of you know, interest rates are at historic lows:

Source: JP Morgan Guide to the Markets, Q1 2015

Take a long look at that chart of nominal (blue line) and real (or inflation-adjusted, gray line) interest rates over the last sixty years. The last time rates were this low, my old man was crawlin’ around in diapers (what a thought!). Can interest rates go down any more? Well, I suppose they can, but it’d only be moderate and highly unlikely. In our history, inflation-adjusted interest rates have rarely fallen below 0%. We’re at 0.46% now. When they have fallen to zero or lower, it’s been a very short stay. Folks tend to not want to lock their money in a vehicle where they’re guaranteed to lose money. With Janet Yellen all but guaranteeing an increase in the Fed Funds target rate later this summer, the headwinds for rates to decline are pretty strong. Take a look at this chart showing rate projections:

Source: JP Morgan Guide to the Markets, Q1 2015

Barring a total global economic collapse, I’d say it’s a relative sure thing that interest rates are due to rise in the near future—the fed and the fixed income markets certainly think so. But, even if you don’t wan’t to go so far as to predict a rise, it’s highly, HIGHLY, unlikely they’ll fall.

Now, look at the historical chart on inflation:

Source: BLS, JP Morgan Guide to the Markets, Q1 2015

Now, this looks funny. I read this and it seems like core inflation is around its lowest level in…yep…50 years. So, where do you think inflation is going? Up? Maybe. Sideways? Maybe. Down? Probably not.

So, let’s add this up. Real interest rates (Ir) will either hold steady or rise this year. Inflation will either hold steady or rise this year. So nominal interest rates (In) will almost certainly hold steady or rise. It looks like this:

Herein, as they say, lies the rub. What happens to stock markets when interest rates are rising off a low base?

Source: JP Morgan Guide to the Markets, Q1 2015

Look at that correlation chart. In statistical analysis, that chart is what’s known as a “slam dunk.” “Slam dunk” is a technical term meaning, “there’s literally no example in the last 50 years where rising interest rates from a low base has occurred during a falling market.”

Said another way, in every case over the last 50 years (that’s a big sample size) when rates have been under 5% (we’re at 1.86% now) and have risen (I made the case for rising rates), stock markets have also risen. The degree of rise has varied, but it’s always happened. I think it will happen again.

Why does this happen? It’s logical to think that when rates start rising, then fixed income investments will become more favorable relative to riskier investments. This is true, but there’s something else going on, too. Think about low interest rates as economic stimulus. Rates are greatly influenced by the federal reserve as a tool to stimulate growth. This economic stimulus acts as medicine to an ailing economy. That medicine only starts being taken away (via raised rates) when the patient is seeming to get better.

Understanding the market and being able to predict the outcome based on the available data is the central aspect when it comes to trading. Here is a link to the article which is widely referred to by trades which helps them develop a better understanding of the prevailing market.

Raising rates won’t cause markets to rise, necessarily. But, for the last 50 years, raising rates has always be accompanied by a rising market–the patient is getting better. Stay invested, Dad!

Thanks for reading!

Eric

Leave a Reply